Global supply shortages mean costs are currently rising for consumers -- but what's the long-term outlook?

"Supply chains differ in terms of product form, size, weight, distance, transportation mode, number of firms in the chain, functions performed, dollar values, cost drivers, materials, demand patterns, competition and more," says Tim Hawkins, an associate professor in UNT's G. Brint Ryan College of Business. "Any one of these facets can affect one supply chain but not another at any point in time, meaning supply chains are nuanced and temporal."

That means, he says, consumers will likely pay the price across various industries. Home values are soaring, as demand has increased -- but the supply of construction workers and building materials have dwindled. Restaurants are dealing with the depletion of their most-desired items, from Chick-fil-A sauce to Starbucks' baked goods. And retailers are struggling to fulfill demand for everything from big-ticket items like cars and appliances to incidentals like liquor (not to mention semiconductor shortages that have further chipped away at the supply chain).

Here, our UNT experts delve into what these shortages mean for many industries -- and what consumers can expect moving forward.

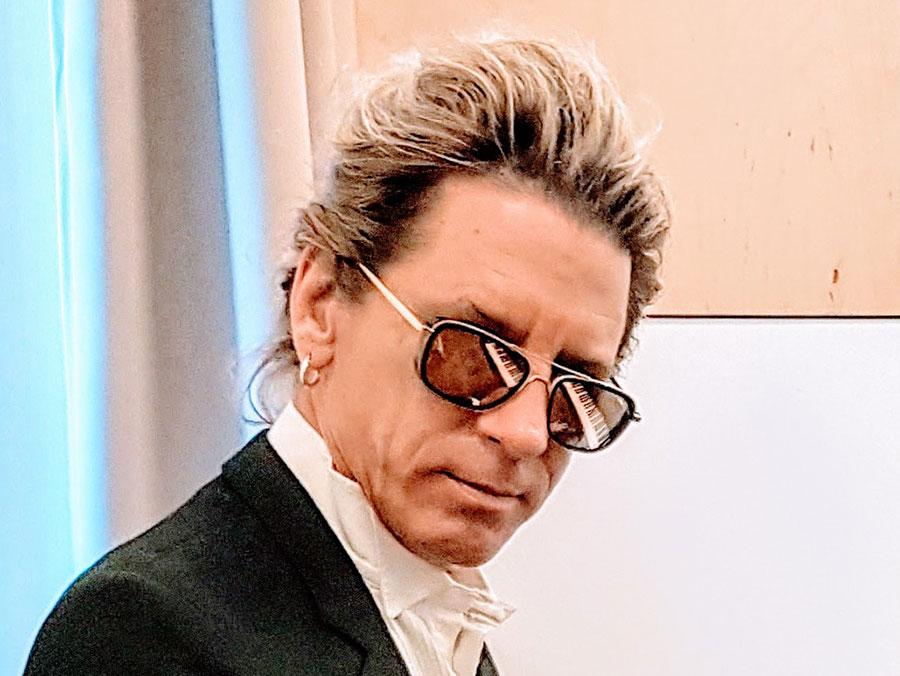

Associate professor, UNT's Department of Marketing, Logistics and Operations Management

"Rising supply chain costs will necessarily be passed along to the consumer. In this environment, consumers may benefit from becoming not only more patient, but more flexible, or creative, in how their needs are satisfied, as product substitutions will likely be commonplace. They also may want to do a bit more homework to find alternative sources of supply to minimize price and understand delivery lead times."

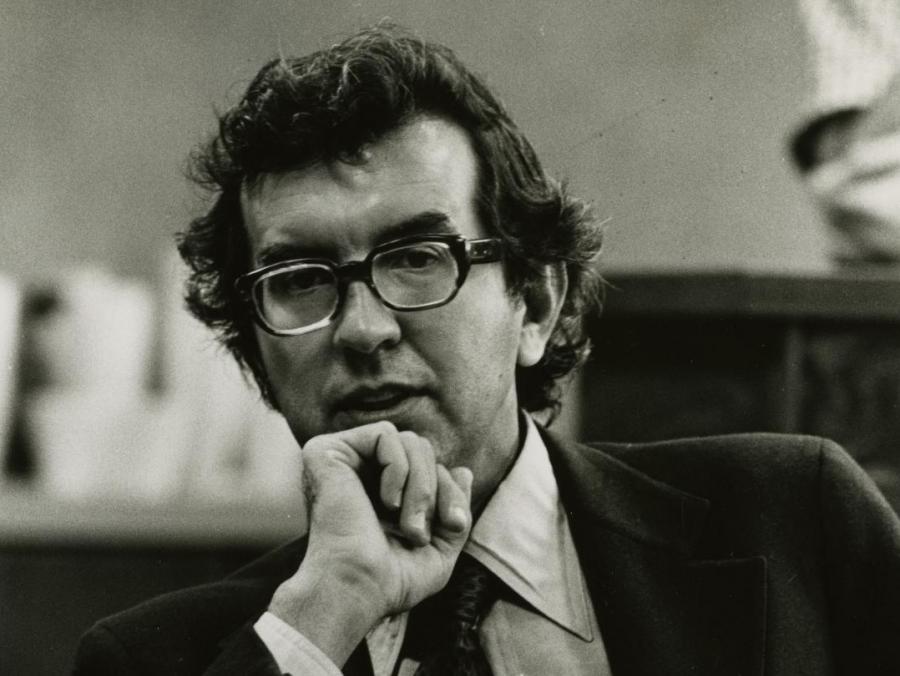

Senior lecturer, construction management, UNT's Department of Mechanical Engineering

"The labor shortage has put a crunch on the supply chain. Without workers to produce materials or drive the trucks, everything has almost come to a screeching halt. Consumers must understand that this is a chain reaction and if a homebuilder promises them a home will be ready in three to six months, they may have to double or triple that time since no one has any control over when the materials will be delivered."

Lecturer, UNT's College of Merchandising, Hospitality and Tourism

"For retailers who are able to secure production, there will be additional logistics costs to bring the merchandise to stores. This will negatively impact retailers' bottom line as they will not be able shift all these costs to consumers. Nevertheless, retailers will have positive sales comps and less markdowns this year. For consumers, they will need to act fast and look for good deals early in the holiday season since inventories will be limited."